Understanding HPI Checks for Cars in the UK

Welcome to our comprehensive guide on HPI checks for cars in the UK! Whether you're buying a new or used car, conducting an HPI check is an essential step to ensure peace of mind and avoid potential issues down the road. In this webpage, we'll explore everything you need to know about HPI checks, including their importance, statistics, and where to conduct them.

What is an HPI Check?

An HPI check, short for Hire Purchase Investigation check, is a comprehensive vehicle history check that provides valuable information about a car's background. It includes essential details such as outstanding finance, previous accidents, mileage discrepancies, and whether the car has been reported stolen or written off.

Why Are HPI Checks Important?

HPI checks are crucial for several reasons:

- Avoiding Fraud: An HPI check can uncover whether a car has outstanding finance or has been reported stolen, helping you avoid purchasing a vehicle with a murky history.

- Ensuring Safety: By revealing any previous accidents or damage, HPI checks can provide insight into the safety and integrity of the vehicle.

- Protecting Investment: Conducting an HPI check can safeguard your investment by ensuring you're not buying a car with hidden issues that could lead to costly repairs or legal complications

HPI Statistics

According to HPI, a leading provider of vehicle history checks in the UK:

- Over 30% of vehicles checked have outstanding finance.

- Approximately 1 in 3 cars checked has a hidden past, such as being an insurance write-off or reported stolen.

- Mileage discrepancies are found in around 1 in 16 vehicles checked.

These statistics highlight the importance of conducting thorough HPI checks before purchasing a car.

Where Can You Conduct HPI Checks?

There are several reputable providers where you can conduct HPI checks in the UK. Some popular options include:

- HPI Check: HPI offers a range of vehicle history checks, including the HPI Check, HPI Check Free, and HPI Premium Check. Costs vary depending on the level of detail required, with prices starting from approximately £9.99.

- AA Car Data Check: The AA provides comprehensive vehicle checks, including information on outstanding finance, mileage discrepancies, and more. Prices start from around £14.99.

- RAC Vehicle History Check: RAC offers vehicle checks that include data on finance, theft, and write-off status, among other details. Prices start from approximately £9.99.

HPI checks play a vital role in ensuring transparency and peace of mind when purchasing a car in the UK. By uncovering hidden issues and providing valuable insights into a vehicle's history, HPI checks help buyers make informed decisions and protect their investment.

Cars are For Sale that seem perfect yet are RECORDED as CAT

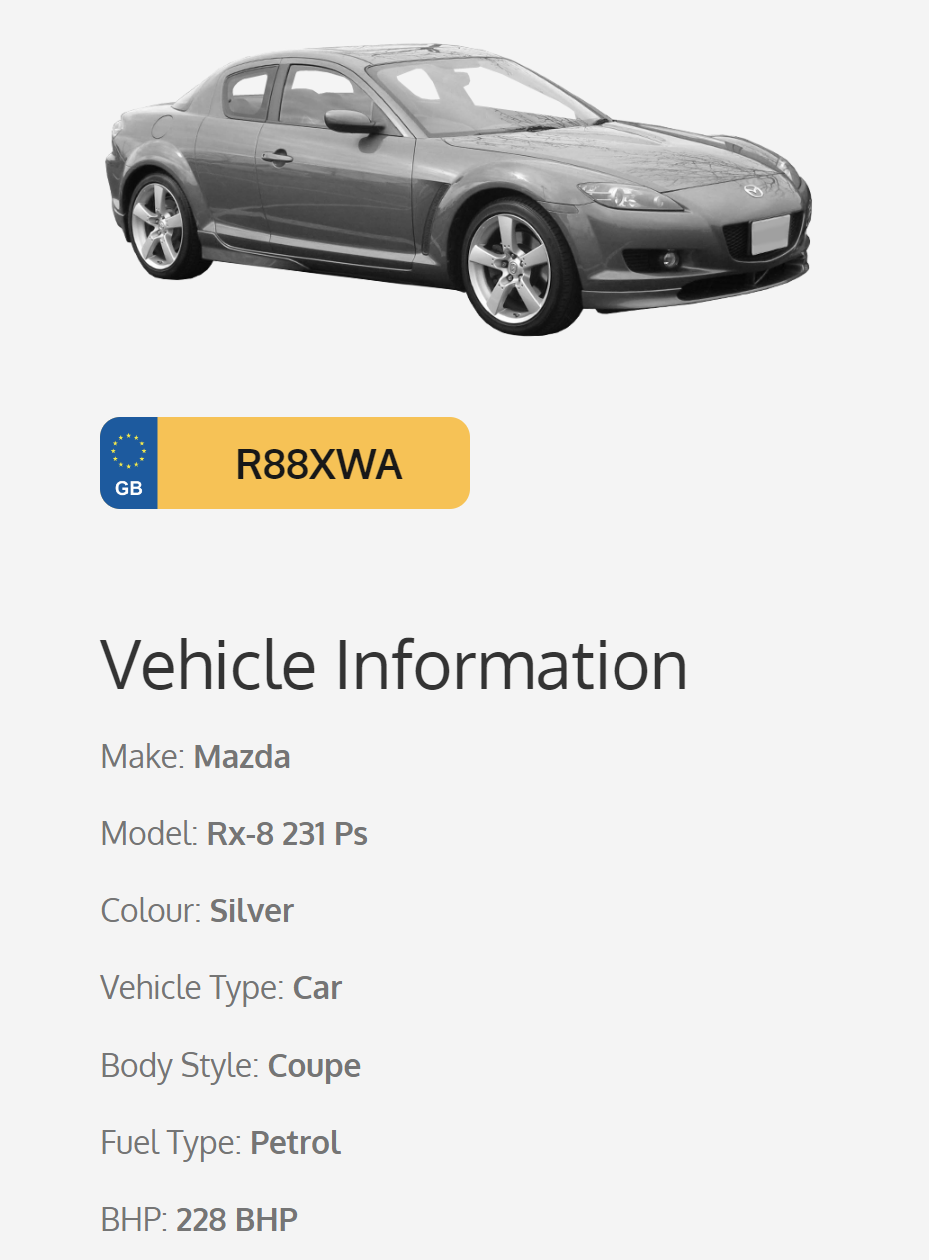

CAT C Example

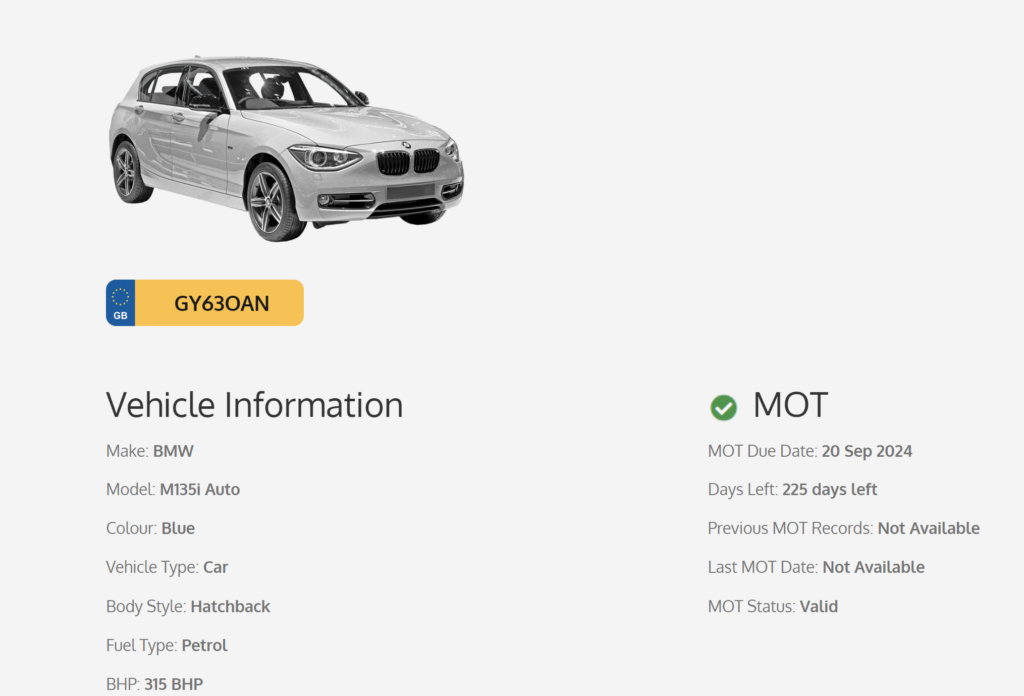

CAT D BMW M135i Example

Insurance Write-off Categories

In the UK, insurance categories, also known as insurance write-off categories, are used to classify vehicles that have been involved in accidents or incidents where the cost of repair exceeds the vehicle's value. These categories provide information about the extent of damage to the vehicle and help insurers and buyers assess the vehicle's condition. As of 2022, the insurance write-off categories used in the UK are as follows:

- Category A (Scrap): Vehicles in this category are deemed unfit for repair and should be crushed. They may have suffered severe damage, making them unsafe for use on the road. No salvageable parts should be retrieved from Category A vehicles.

- Category B (Break): Vehicles in this category are also deemed unfit for repair but may have salvageable parts. However, these parts must not be used to repair other vehicles for road use. Category B vehicles are typically sold for parts or scrapped.

- Category C, now known as Category S (Structural), indicates that the vehicle has suffered structural damage as a result of an accident or incident.

- Category D, now known as Category N (Non-Structural), indicates that the vehicle has suffered non-structural damage, such as cosmetic or electrical issues, as a result of an accident or incident.

- Category S (Structural): Formerly known as Category C, vehicles in this category have suffered structural damage that could potentially be repaired. However, the cost of repair is often higher than the vehicle's value. Once repaired, Category S vehicles can be returned to the road but must pass a thorough inspection to ensure they are safe for use.

- Category N (Non-Structural): Formerly known as Category D, vehicles in this category have suffered non-structural damage, such as cosmetic or electrical issues. The damage is typically less severe than Category S vehicles, and the cost of repair may be lower. Once repaired, Category N vehicles can be returned to the road after passing an inspection.

It's important to note that insurance categories are used by insurers to assess the damage to a vehicle and determine whether it is economical to repair. However, these categories do not always indicate the extent of damage accurately, and buyers should conduct thorough checks before purchasing a vehicle with an insurance write-off history. Additionally, vehicles with insurance write-off history may have lower resale value and could be more challenging to insure in the future.